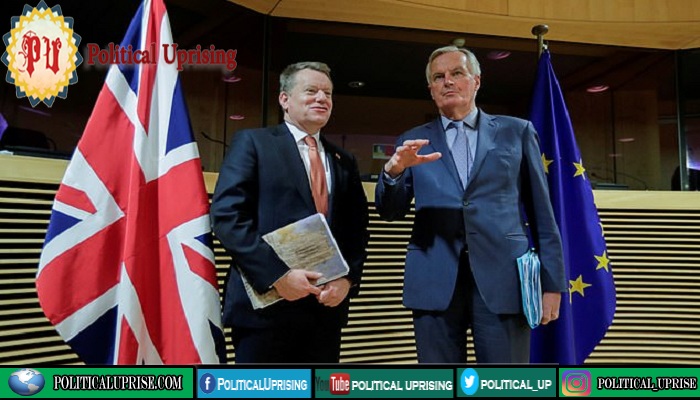

IMF says Britain should ask for an extension to its post-Brexit transition period to ease uncertainty at a time when the world economy is being hammered.

The coronavirus has increased the challenges of negotiating a new trade agreement for the UK before December 31.

The United Kingdom should ask for an extension to its post-Brexit transition period to ease uncertainty at a time when the world economy is being hammered by the coronavirus pandemic, the head of the International Monetary Fund said.

“It is tough as it is. Let’s not make it any tougher,” Kristalina Georgieva said.

“My advice would be to seek ways in which this element of uncertainty is reduced in the interests of everybody, of the UK, of the European Union, the whole world.”

British govt asks manufacturers to build medical equipment

The transition period is due to end on December 31, and barriers to exports and imports will go up if a new trade agreement is not reached by then, a challenge which has been made harder by the coronavirus crisis.

Georgieva was speaking after the IMF warned on Tuesday that the world economy is heading for its steepest downturn this year since the Great Depression of the 1930s.

IMF managing director praised the emergency measures taken by UK’s finance ministry and the Bank of England which she said had been taken “early” and were well-coordinated.

“That very strong package of measures is helping the UK, but given the UK’s sizeable role in the world economy, it’s actually helping everyone,” Georgieva said.

British airline goes into administration as Corona hurts demand

The government has increased spending and cut taxes in measures that the UK’s budget office estimates will cost 100 billion pounds ($125bn).It has also offered guarantees for 330 billion pounds ($412bn) of company loans.

The Bank of England has cut interest rates to 0.1 percent and ramped up its bond-buying by a record 200 billion pounds ($250bn).