Beijing imposed steep new tariffs on U.S. goods, escalating its trade battle with the Trump administration.

The move rattled global markets, drove gold to record highs, and fueled inflation fears, as confidence in U.S. assets took a hit.

China raised tariffs on U.S. imports to 125% on Friday in retaliation for President Donald Trump‘s decision to hike duties on Chinese goods, marking a dramatic escalation in the ongoing U.S.-China trade war.

The tit-for-tat moves between the world’s two largest economies threaten to freeze more than $650 billion in bilateral trade, upending global supply chains and deepening fears of a global slowdown.

US to restore tariffs on steel and aluminium

Despite the tensions, U.S. stocks closed higher, capping a turbulent week. However, signs of market stress were evident. Gold surged to a record high, U.S. 10-year bond yields jumped by the most since 2001, and the dollar slumped—reflecting growing investor unease.

“The recession risk is much higher now than it was just a couple of weeks ago,” said Adam Hetts, global head of multi-asset at Janus Henderson. “Markets are pricing in prolonged uncertainty.”

Trump’s administration, doubling down on its economic strategy, invoked a rarely used law to justify its tariffs and is pushing forward with deals with other nations, claiming they’ll ultimately benefit U.S. trade.

White House Press Secretary Karoline Leavitt reinforced the administration’s tough stance, stating, “When the United States is punched, the President will punch back harder.”

Inflation fears surged alongside tariffs. U.S. consumer inflation expectations jumped to 6.7%—the highest level since 1981—according to a University of Michigan survey. Economists warned that “tarifflation” could push prices even higher.

EU Proposes Zero-Tariff Deal with US, Prepares for Trade War Over Tariffs

“These aren’t just trade tactics; they’re inflationary pressure points,” said Bill Adams, chief economist at Comerica Bank.

Beijing condemned the U.S. measures as “unilateral bullying,” with a Chinese embassy spokesperson warning, “China will never bow to maximum pressure.” Although Chinese officials said this may be their last direct tariff response, they left the door open for other forms of retaliation.

As Trump imposed a 90-day tariff pause for dozens of countries while targeting China, his administration reported more than 75 nations had reached out for new trade deals. Meanwhile, countries like India, Japan, and Vietnam are scrambling to adjust their policies to avoid getting caught in the crossfire.

China exclude more tariffs on US goods before trade deal

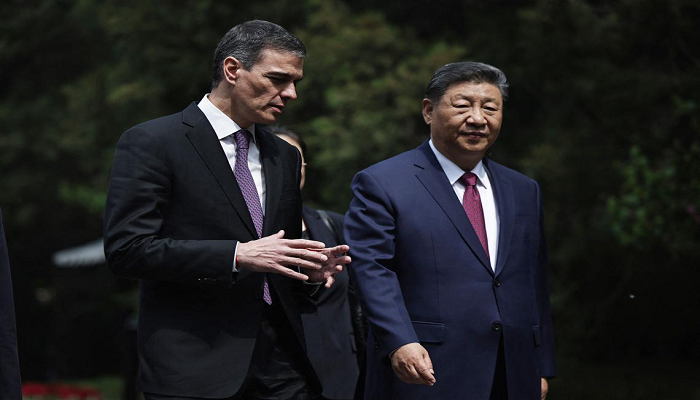

Chinese President Xi Jinping called for unity with the EU against “unilateral bullying,” and signed new agricultural trade agreements with Spain, signaling a pivot toward European partners.

Despite efforts to reassure markets, business leaders remain concerned about rising costs, disrupted supply chains, and the long-term consequences of economic decoupling between the U.S. and China.