Donald Trump executive order passed in November blocks US investors from buying securities of Chinese firms allegedly under military control.

The administration of US President Donald Trump strengthened an executive order barring US investors from buying securities of alleged Chinese military-controlled companies, following disagreement among United States agencies about how strictly to adhere to the directive.

The Department of the Treasury published guidance clarifying that the executive order, released in November, would apply to investors in exchange-traded funds and index funds as well as subsidiaries of Chinese companies designated as owned or controlled by the Chinese military.

The “frequently asked questions” or FAQrelease, posted on the Treasury website on Monday, came after some news outlets reported that a debate was raging within the Trump administration over the guidance. The State Department and the Department of Defense had pushed back against a bid by Treasury Department to water down the executive order, a source said.

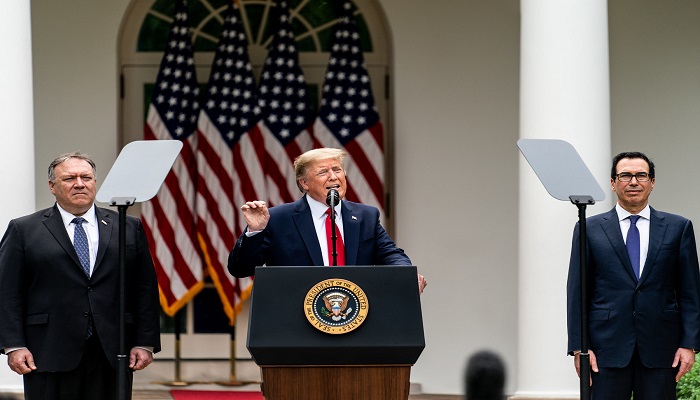

Secretary of State Mike Pompeo said on Monday that the announcement “ensures US capital does not contribute to the development and modernisation of the People’s Republic of China’s (PRC) military, intelligence, and security services”.

“This should allay concerns that US investors might unknowingly support (Chinese military-controlled companies) via direct, indirect, or other passive investments,” he added.

Specifically, some media outlets reported that the Treasury was seeking to exclude Chinese companies’ subsidiaries from the scope of the White House directive, which bars new purchases of the securities of 35 Chinese companies that Washington alleges are backed by the Chinese military, starting in November 2021.

The guidance released on Monday specifies that the prohibitions apply to “any subsidiary of a Communist Chinese military company, after such subsidiary is publicly listed by Treasury.” It added that the agency “intends to list” publicly traded entities that are 50 percent or more owned by a Chinese military company or controlled by one.

“Treasury’s published FAQ represents a clear victory for the US security community in its determined effort to preserve strong capital markets sanctions associated with [the executive order] the first of their kind,” said Roger Robinson, a former White House official who supports curbing Chinese access to US investors.

The November executive order sought to give teeth to a 1999 law that mandated that the Department of Defense compile a list of Chinese military companies. The Pentagon, which only complied with the mandate this year, has so far designated 35 companies, including oil company CNOOC Ltd and China’s top chipmaker, Semiconductor Manufacturing International Corp.

Since the November order, index providers have already begun shedding some of the designated companies from their indexes.