Twitter American microblogging reports its highest-ever yearly growth in daily users to lockdowns and increased conversations around coronavirus pandemic.

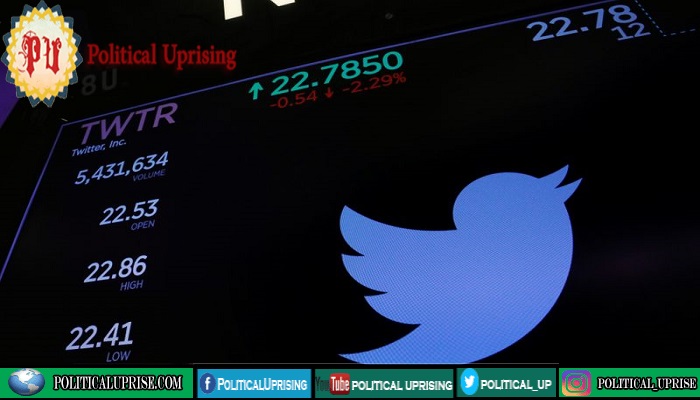

Twitter on Thursday reported its highest-ever yearly growth of daily users who can view ads, beating analysts’ estimates on usage and sending its shares up more than 6.5 percent.

Twitter’s average monetisable daily active users (mDAU) increased 34 percent year over year to 186 million, above analysts’ estimate of 176 million, in a rise it said was primarily driven by external factors such as shelter-in-place requirements and increased conversation around the COVID-19 pandemic.

But the company missed Wall Street’s lowered expectations for quarterly revenue, as the coronavirus-spurred economic slowdown battered the company‘s largely events-oriented digital ads business.

Ad sales, which make up 82 percent of Twitter’s revenue, sank 23 percent to $562m, a drop the company attributed to brand spending pauses tied to the pandemic and US civil unrest. Analysts had expected $585m, according to IBES data from Refinitiv.

Chief Executive Jack Dorsey opened a conference call with analysts by apologising for the hack that compromised the accounts of high-profile users last week, saying “We feel terrible”. In a statement, Dorsey said Twitter had taken steps to improve its security and “resiliency against targeted social engineering attempts”.

Erdogan party moves to tighten grip on social media giants

Total revenue came in at $683m, down 19 percent year-over-year, helped by steadier sales growth from the licensing of users’ posts to researchers and marketers.

Twitter has struggled to build out its ad offerings, leaving it reliant on a suite of promotional tools geared towards advertising around big events and product launches, which have all but vanished during the pandemic.

The company said it finished rebuilding its ad management technology in the second quarter, which would support faster development of new formats going forward, and was rolling out measurement tools for “direct response” ads used by app developers.

On the conference call, Chief Financial Officer Ned Segal declined to give details about the impact of a July social media advertising boycott that was intially focused on Facebook but spread to other platforms. Dorsey said Twitter’s actions to protect conversations on the platform were being noted by advertisers.

Twitter also said it was exploring “subscriptions and other approaches to complement our advertising business,” such as commerce, though it was not expecting any revenue to result this year. Dorsey said on the call that the company would have a “really high bar for when we would ask consumers to pay for aspects of Twitter”.

The company reported a second-quarter loss of $1.2bn, largely driven by the reversal of a tax benefit established last year when the company transferred intellectual property to Ireland. Because of the second quarter’s steep coronavirus-related losses, Twitter did not make enough money to take advantage of the tax benefit.

Facebook considers political-ad blackout ahead of US election

Adjusted to exclude the tax considerations, the company incurred a loss of $127m, or 16 cents per share, roughly in line with analyst expectations of a $125m loss. It had an adjusted profit last year of $37m.

Echoing earlier guidance, Twitter said it expects data licensing revenue to “moderate” for the rest of the year.

Costs and expenses grew 5 percent to $807m, below the increase in the low teens that Twitter had forecast. The company said it anticipated expense growth of 10 percent or more in the third quarter.

Social media rival Snap Inc missed user growth estimates earlier this week, as its usage bump from coronavirus lockdowns petered out sooner than expected, but it beat targets for revenue gains.